Menu

Close

On Wednesday, the Government published draft amendments to the Finance Bill 2016, which included the restriction of travel and subsistence tax relief for limited company contractors.

From 6th April 2016, contractors operating through a personal service company will not be able to claim tax relief on travel and subsistence costs if they are inside IR35.

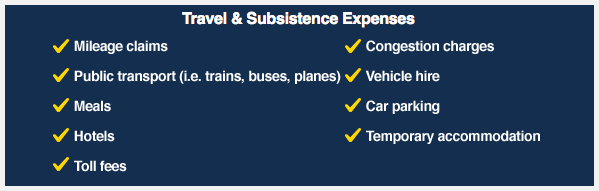

Currently contractors are able to claim relief on these expenses through their companies, reducing their corporation tax, but with the new restriction those operating inside IR35 should no longer claim. If a contractor is found to be claiming travel and subsistence expenses incorrectly, the expenses will be reclassified as income and there will be a tax liability.

This means that you will still need to assess your IR35 status with each engagement, but now, if you are operating within the legislation, you will need to avoid claiming expenses in relation to travel and subsistence as well as making a deemed payment at the end of the tax year.

If you are subject to an IR35 investigation and subsequently found to be ‘caught’, you will have to pay all IR35 liabilities and liabilities in respect of travel and subsistence claims, increasing the financial risk of not applying IR35 correctly.

If you require further information or advice, please call us on 0116 2690992.

Ask away! One of our team will get back to you!