Menu

Close

Self assessment tax returns (SATRs) can be inconvenient at the best of times – we all know how painful the submission can be. With the pressure placed on an industry of flexible workers, we want to focus on keeping things simple, offering our customers a way to make their lives easier.

That’s why, with any purchase of our leading insurances, you can now benefit from 30% off the award-winning Self Assessment Tax Return service with GoSimpleTax.

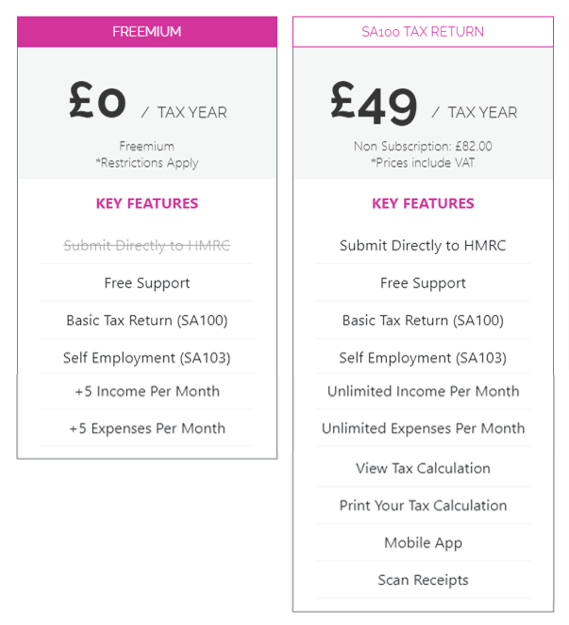

Simply sign up for a free account via the links provided following your purchase of Qdos insurance, and GoSimpleTax will email you your unique discount code to upgrade. So you can even try it out before you pay for the full service (which is only £49+VAT before your discount).

The annual inconvenience of filing tax returns can be a thing of the past for customers of our award-winning insurances. The SATR service not only simplifies the process but enables customers to record income and expenses in real-time.

“We are always looking for ways to provide our customers with all the tools and information they need to succeed. With an enhanced offering, we want to give our customers one less thing to worry about.”

“Our free IR35 Contract Assessment service for contractors has always been incredibly popular so we wanted to provide something equally beneficial to our sole trader customers and I think the self assessment service does just that.”

The self assessment service is effectively an online accounting software that helps take the stress out of tax returns. Available on iOS, Android, as well as desktop, it allows users to seamlessly complete tax returns with automated calculations throughout the tax year.

The receipt scanning feature that comes as part of the service, and is available on the app, allows you to upload receipts that are immediately added to your accounting records. By uploading information to the GoSimpleTax platform, the software works out exactly how much is owed, and even provides tax saving suggestions.

In addition to this, through the service, your tax returns can be submitted directly to HMRC. Helping you stay on top of deadlines and avoid penalties.

The GoSimpleTax platform also integrates with popular bookkeeping software including FreeAgent, FreshBooks, and QuickBooks.

The self assessment tax return service expands Qdos’ offering and support for self-employed workers, and is available to both contractors and sole traders, as well as partnerships.

Take a look at GoSimpleTax's expanded comparison table here for further details.

Established in 2013, the team at GoSimpleTax understand that tax returns aren’t always a walk in the park.

Through the team’s extensive experience, they have established themselves as leading self assessment software providers with over 15,000 subscribers to the service. Their handy app makes annual tax returns simple.

GoSimpleTax are an approved commercial software supplier and Making Tax Digital (MTD) ready.

For more information on the self assessment tax returns and which taxes are applicable to you, download our free Starter Guide to Tax for the Self-Employed.

Ask away! One of our team will get back to you!